Tip of the Week: Ability to Apply Two Taxes

Flexibility needs to be at the core of any legal billing software. Whether it’s something simple that is often left out, like the ability to customize your invoice with your own logo, or something a bit more advanced like applying two taxes to an invoice, you need adequate flexibility in generating invoices to meet your customers’ needs. We know that especially firms in Canada may need to charge two different taxes and the taxes have to be on separate lines of the invoice. This week’s Tip of the Week takes a look at how to set up and apply two taxes for your invoices.

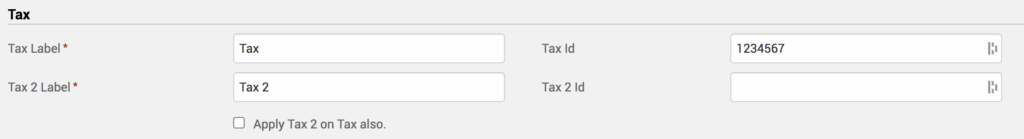

First off, head under Accounts>Settings>General tab. Here you can specify labels and IDs for the Taxes, or you can even name one of the fields an ‘Admin Fee’ and the other ‘Tax’ in case you want to charge both.

There’s a checkbox at the bottom of this section that reads ‘Apply Tax 2 on Tax also‘. Enabling this means the second Tax (‘Tax 2’ field) will tax the first tax (‘Tax 1’ field). See example below:

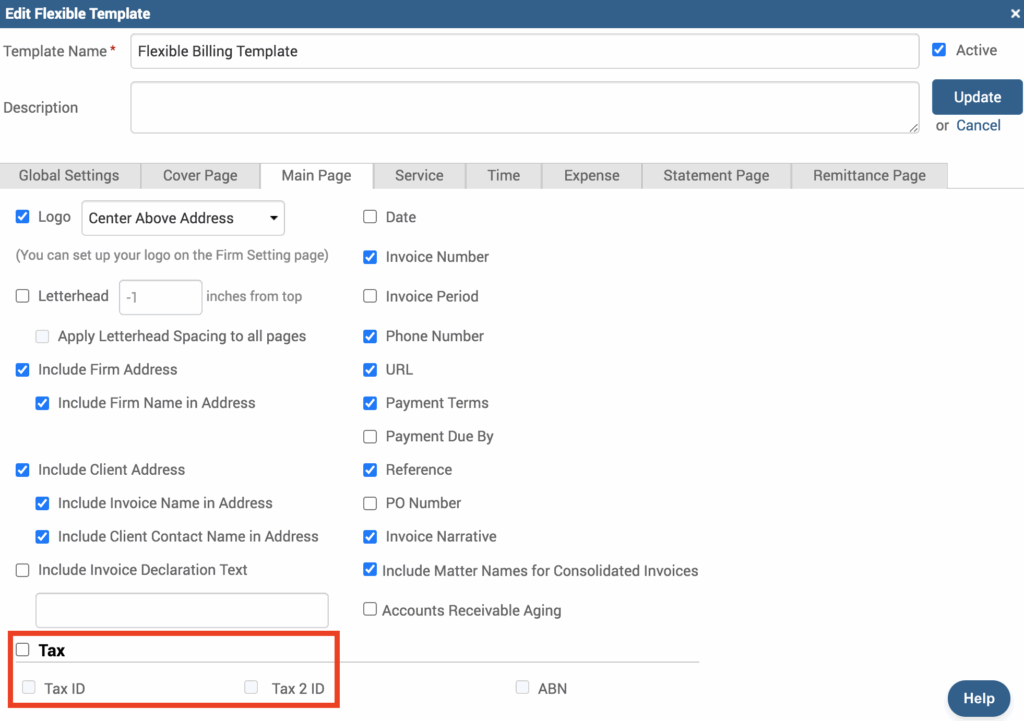

Now, if you have set up an ID for your Taxes, you’ll need to make sure you enable these to show up on your invoices. To do that you’ll need to head under Invoices>Settings>Flexible Templates. Open the template you’ll be using for the invoices or create a new one.

Click to edit the template, and under the Main Page tab ensure the checkboxes are enabled against ‘Tax‘ and ‘Tax 2‘ towards the bottom (these labels may appear different if you changed the Tax label to something else under Account>Settings).

For more information on how to apply Tax rates to Clients, Time Entries, Expense Entries, click here.

If you’d like to contact TimeSolv support for help, please call 1.800.715.1284 or Contact support!

wherever you do.

TimeSolv in action.