Tip of the Week: Setting up a tax or admin fee

TimeSolv allows users to easily set up the taxable status for each client separately, and define the individual rates for time and expense entries. Alternatively, your practice may charge other monthly percentage fees, such as an Admin Fee. This Tip of the Week will walk you through setting this up.

Setting up tax

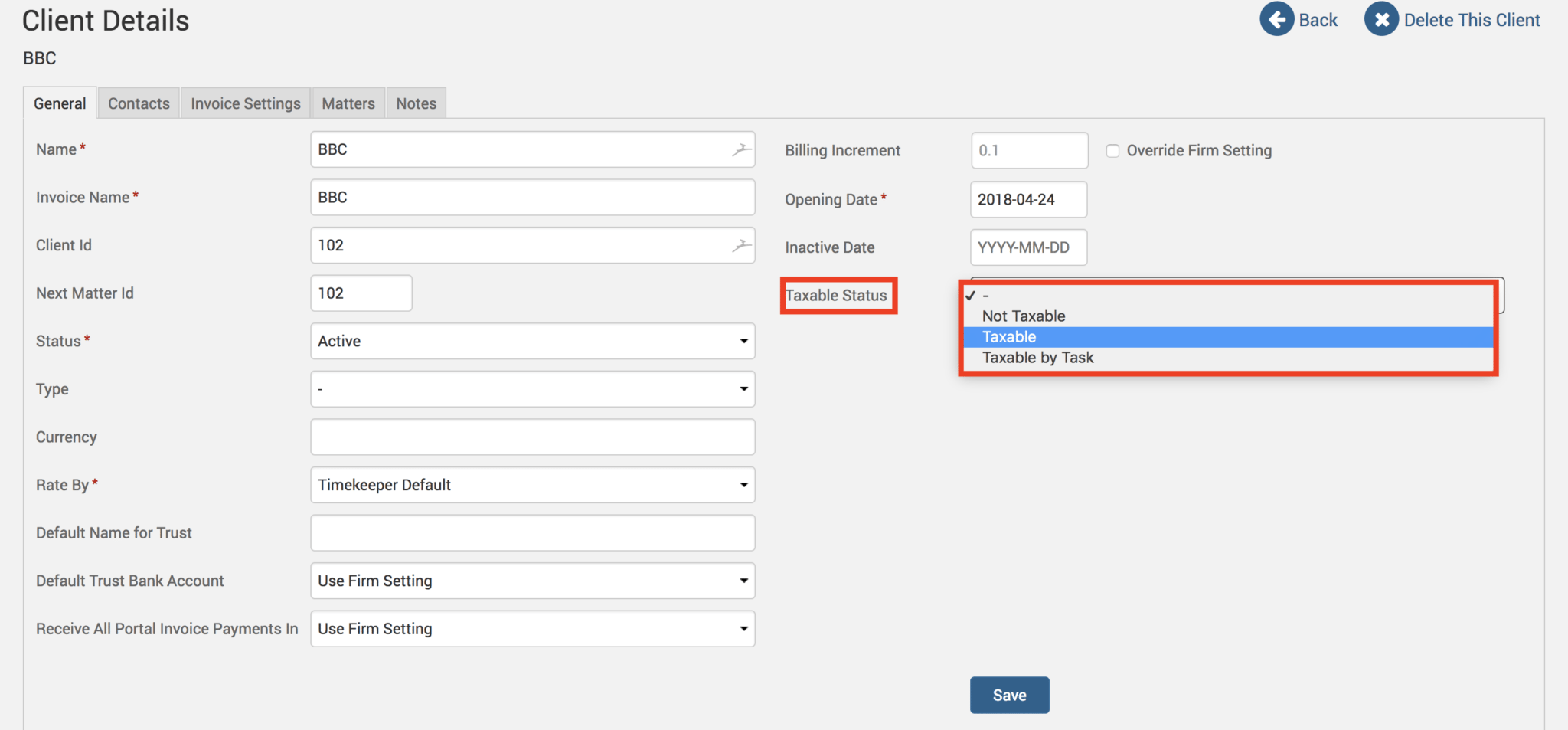

Users can head under individual client details to specify whether the client is simply Taxable or Taxable by Task. To do this, go under Clients>Clients & Matters>[client name]>Taxable Status.

Taxable by Task means that when a Task/Activity code with a tax rate set up against it is applied to an entry for this specific client, the tax rate will be applied to their invoice.

Taxable means every entry has the specified tax percentage applied to the invoices.

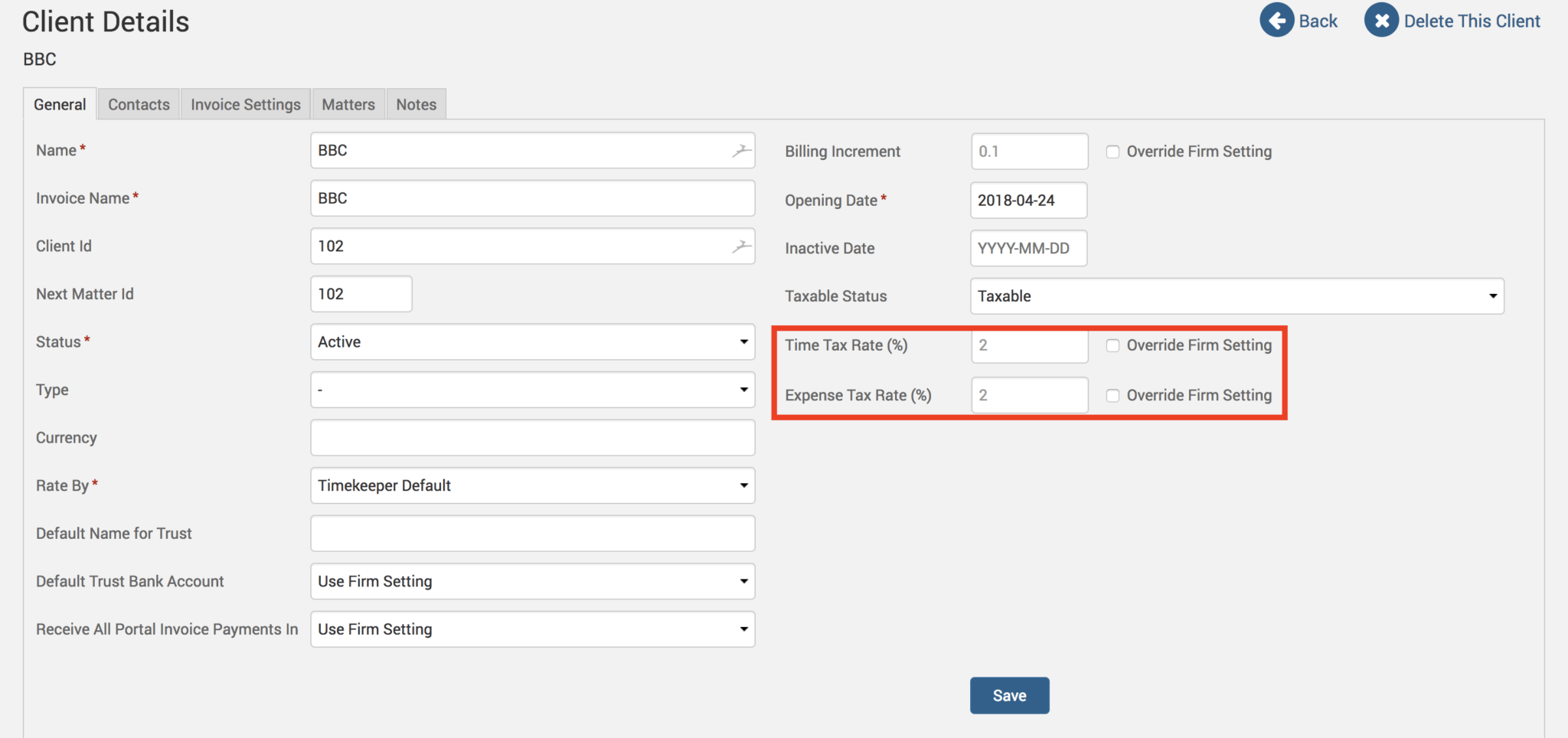

When users select either Taxable or Taxable by Task from the drop-down list of options, two fields will appear below allowing you to specify the Time and Expense tax rate percentage. If these percentages are already set up under Time>Settings or under Expense>Settings, you may select the ‘Override Firm Setting’ checkbox to customize the tax rate for this client as a different amount from the firm-wide settings.

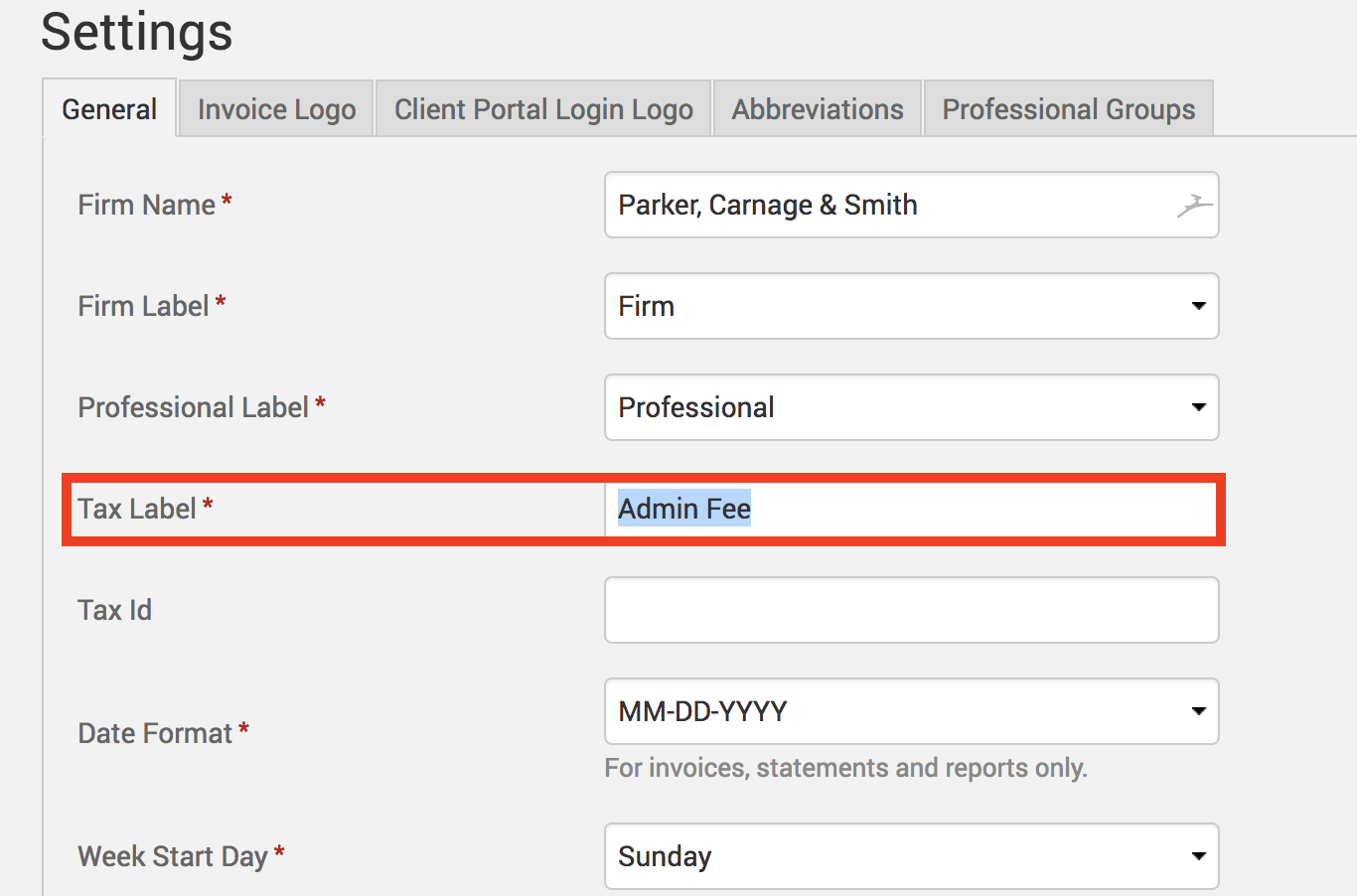

Customizing tax label

Alternatively, users can customize the tax label field to whatever is needed for their business needs, such as an admin fee. Click on Account>Settings>Tax Label. Specify the custom label you wish to rename it to (example below).

Now, instead of seeing the term ‘tax’ you will see, for example, ‘Admin Fee’ in place of it. The invoice will also show your customized label.

If you’d like TimeSolv support to help you in understanding how to set up a tax or admin fee, please call 1.800.715.1284 or Contact support.

wherever you do.

TimeSolv in action.