At TimeSolv, we’re constantly striving to give you the flexibility you need to do business the way you want and what your clients demand. We feel software should fit your business practices, not the other way around.

With that tenet in mind, we’ve been hearing from a lot of customers about needing more flexibility in how statements are presented. We listened.

The TimeSolv app will release an update Tuesday, July 12 at 5 p.m. Central time with a host of new options in how to present Statements to your clients.

- You can now present a Statement balance based on the date of previous invoices or the current date, which is the current option.

- A chronological list of all transactions, including how funds are transferred from the Trust Account can now be displayed on the Statement

- Clients can now view details of each payment that was received by your firm

Our goal is to allow you to present a Statement that is completely clear to your client so time spent explaining the Statement can be reduced.

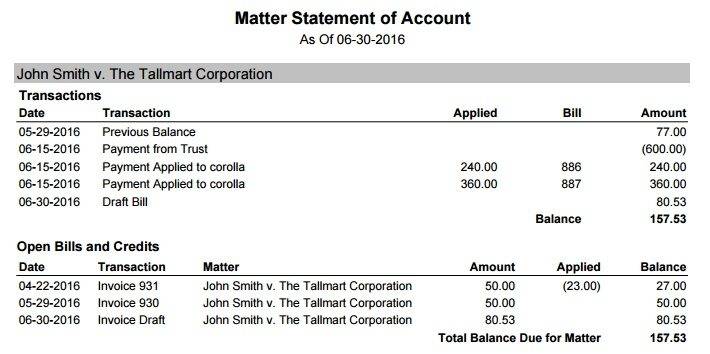

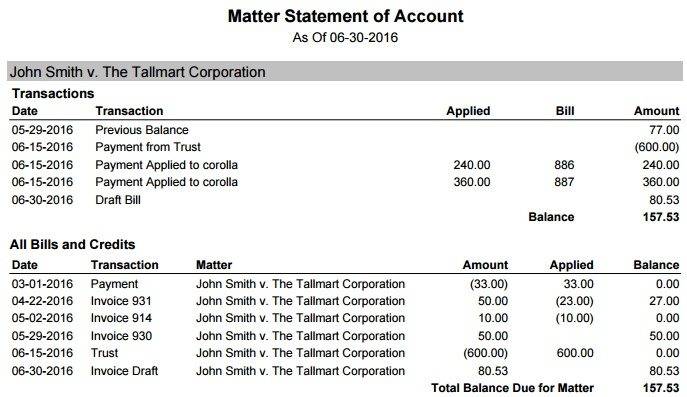

Here’s how the new Statements will look starting Tuesday afternoon with the default settings:

To enable the new features, go under the Invoice tab to Settings and choose Flexible Templates. Either click on an existing template name to edit or create a new flexible template. You’ll then want to choose the Statement of Account Page tab. Currently, you only have three options: include the statement of account page, omit payments applied section or include Trust Accounts.

Now, you’ll see another host of options. Let’s review these new features.

Reprinting Old Invoices with Statement

Statements currently update as time goes on to include the most current information, even if you need to reprint an old invoice. Now you have the ability to reprint an invoice with a Statement that presents information just like on the day it was created. Under the Include Statement of Account Page, you’ll now have a dropdown menu to compute the balance due as of the current invoice or as of the current date.

If you need to reprint an old invoice, chose as of the current invoice and your Statement will now present information as of that invoice, whether it was created two months ago or two years ago. Think of it as a snapshot in time for that client.

If you’d like to present an old invoice that includes the balance due as of the current date, which is your only option right now, simply choose as of current date.

PLEASE NOTE: This is the default option for computing balance due, so if you like how Statements are presented currently, you don’t need to change anything.

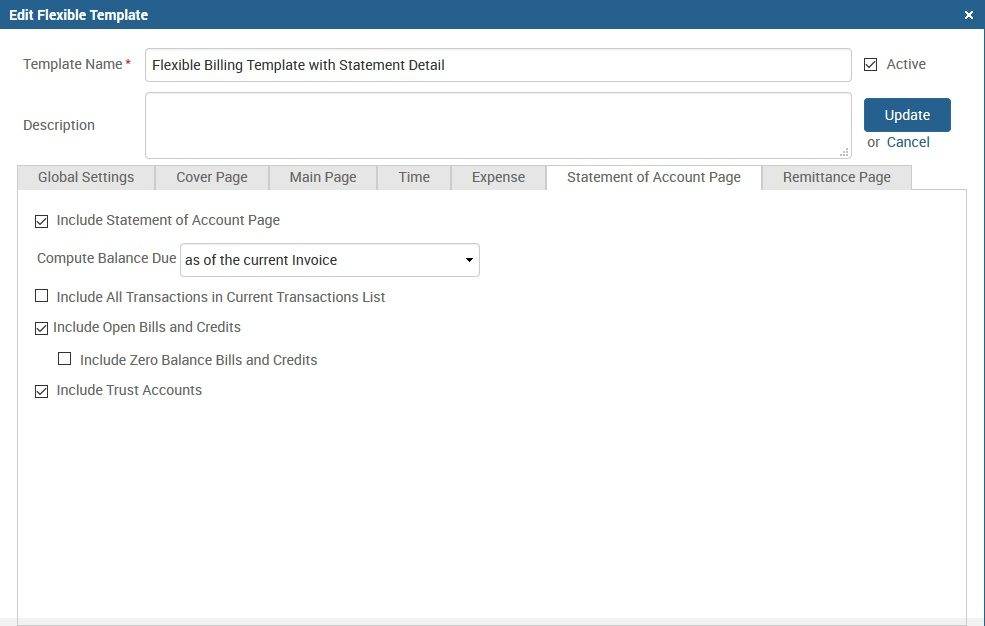

Showing Transactional History

Statements can now show transactional history. Show your clients when payments were received along with when invoices were marked as paid. Simply check the box labeled Include All Transactions in Current Transactions List. Statements with transactional history will now look like this:

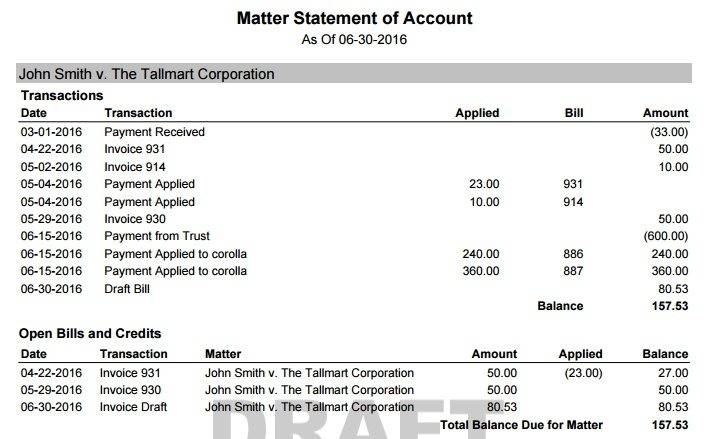

Display all open bills and credits

You can also now show all invoices and payments that recorded for a specific project and provide a comprehensive list of all invoices that have ever been sent along with current balance on each one. Payments will also be displayed and show if they have been fully allocated. Simply check the box called Include Open Bills and Credits as well as Include Zero Balance Bills and Credits to include that information.

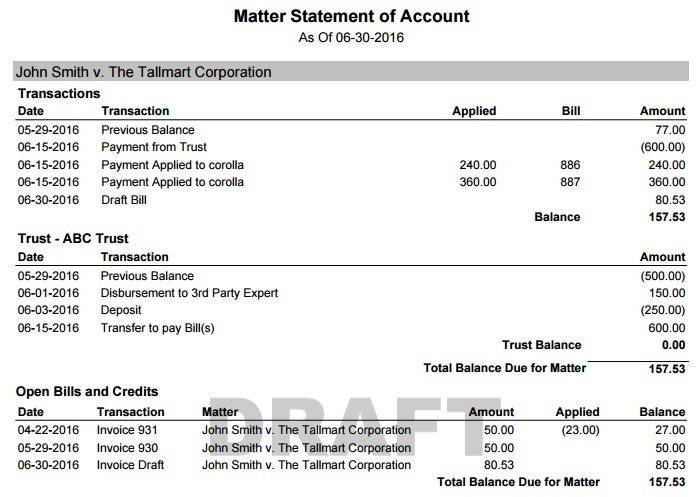

Your Statement will now look like this:

Trust Account Details

You now have even more detail with Trust accounts when you check the Include Trust Accounts box. Trust account detail will now show all transactions so there will never be any confusion on how the current balance is calculated.

If you’d like help adjusting your Statements to include these new features, please call us at 1.888.570.0475 or click below to schedule your free 30-minute online support session with one of our legal billing experts.

SCHEDULE SUPPORT TIME