Whether you are charging retainer invoices for routine legal advice or agreeing to be on standby for a case, a retainer invoice is an important part of your monthly income as a result of your legal services. It is a fee that not only protects you after you have begun working for a client but also ensures a guaranteed income amount in case of unforeseen circumstances delaying payment from the client. This week’s Tip of the Week takes a look at TimeSolv’s latest enhancements to Retainer Invoices.

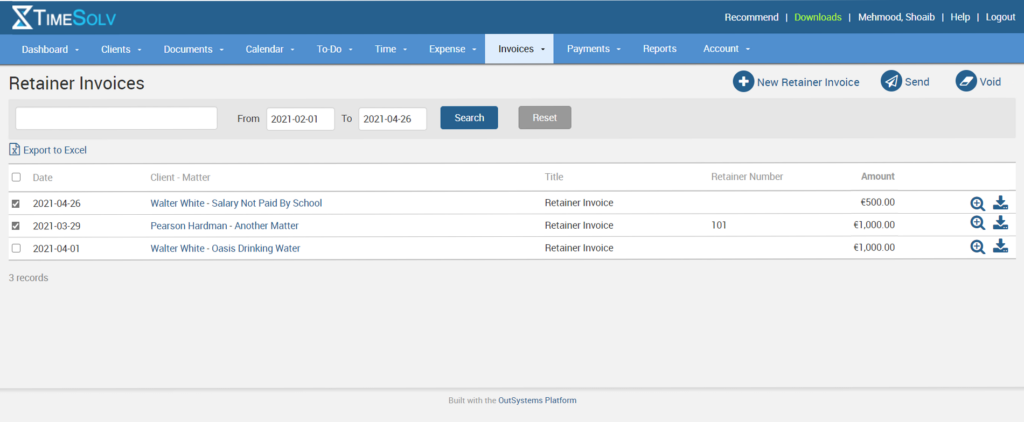

Users now have the ability to download, preview, void, and resend Retainer Invoices easily from under Invoices>Retainers screen.

We’ve even added search filters to the screen based on Client-Matter, their ‘Status’, and whether or not the recurring payment has any errors associated with it so that users do not have to scan the entire list.

With this latest update, users can fully utilize the Retainer Invoices feature in TimeSolv as we continuously evolve to help make your billing processes more efficient and effective.

If you’d like to contact TimeSolv support for help, please call 1.800.715.1284 or Contact support!